This special-risk insurer and industry leader sought a fast-acting remedy to its operational growing pains. The company needed to reduce its claims backlog, boost service levels, lower processing costs, and create a platform for growth. We started with optimizing their Management Operating System (MOS), but that was only the beginning.

Project Overview

Performance Results

Background

Our client is a self-contained division of a large insurance company. It offers high-limit-accident medical expense products to colleges, universities, K-12 schools and sponsoring organizations.

These plans cover student-athletes competing in sponsored activities, games and practices. Among other functions, the business unit markets, underwrites and services policies, collects premiums, administers claims, and handles case management.

Situation Analysis

The company needed to reduce its claims backlog, boost service levels, lower processing costs, and create a platform for growth.

However, operationally, the company was experiencing high claims processing costs, a persistent backlog of claims and related correspondence lack of an effective Management Operating System, and overall declining service levels.

Our Approach

The POWERS team established performance standards by position, enhanced frontline leader and supervisor training, and implemented management systems to track productivity, backlog and cost of claims.

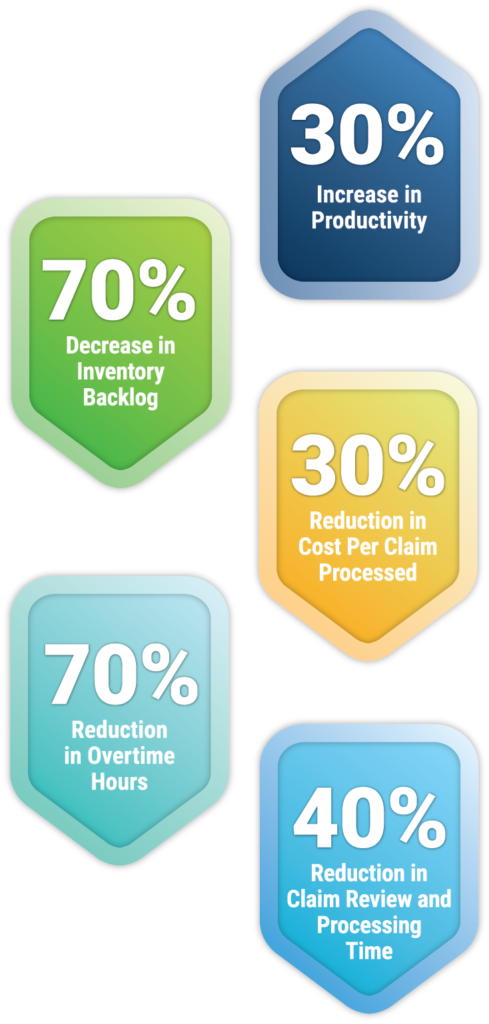

Overall, the performance improvements included:

- Enhanced supervisory training via workshops and train-the-trainer programs

- Implemented front-office tools to support growth

- Improved the Management Operating System:

- Central reporting system

- Identified process bottlenecks

- Developed time and performance standards

- Implemented claims inventory tracking system

- Developed daily/weekly reports

Results

By reshaping the behavior of their people and implementing new management controls, the contracts group sharply reduced its case backlog and turnaround times.